Earlier this month, it said it would shed 10% of its global workforce.

Figures for the first quarter of 2024 revealed revenues of $21.3bn, down on analysts’ predictions of just over $22bn.

But the decision by Tesla to bring forward the launch of new models from the second half of 2025 boosted its shares by nearly 12.5% in after-hours trading.

The EV maker did not reveal details on pricing of the new vehicles.

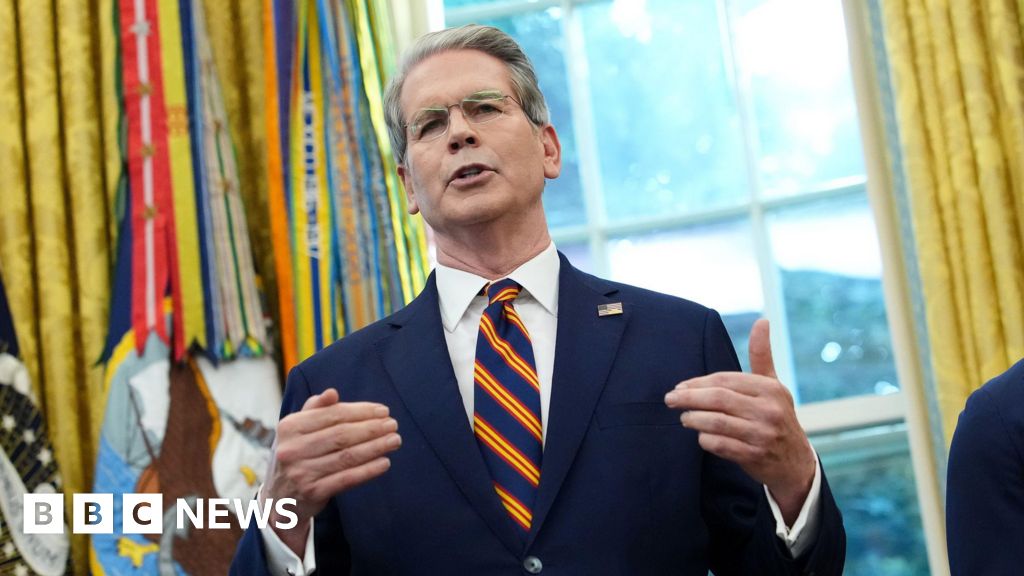

Mr Musk will face investors in a conference call on details of the new models, possibly to include the Model 2 (a cheaper Tesla vehicle which Reuters reported had been shelved in April).

However, the company has already been on a charm offensive, trying to win over new customers by dropping its prices in a series of markets in the face of falling sales.

Tesla said its situation was not unique.

“Global EV sales continue to be under pressure as many carmakers prioritize hybrids over EVs,” it said.

Chinese models have also flooded the market and undercut Tesla’s price point, while still providing reliability.

As a result its share price has fallen by around 40% since the start of this year.

But Tesla has faced similar issues with its stock price in the past – falling as low as $113 in January 2023 – before it more than doubled.

And that is not the end of Tesla’s troubles, after the car firm had to recall thousands of its new Cybertrucks over safety concerns.