Hope Webb and Emma Clifford Bell,BBC Scotland News

BBC

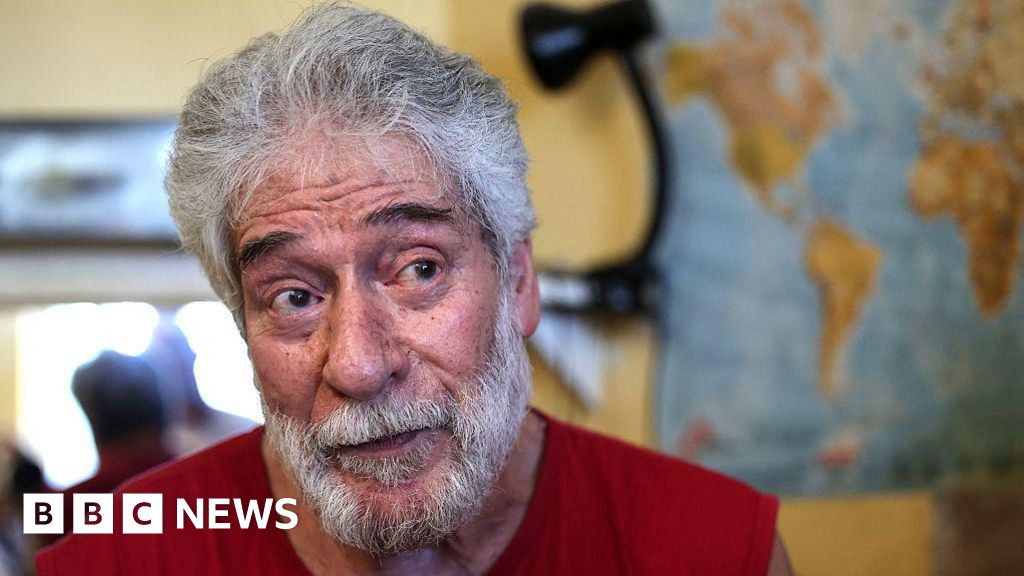

BBCChronic pain caused by fibromyalgia means that Caroline Cawley has been unable to work for eight years and she finds it difficult to travel.

If the local post office is closed, the 41-year-old faces the choice of paying a £1.99 fee at her nearest cash machine or taking a bus to a supermarket to withdraw money.

This is just one of the added costs she faces to access her own money.

Caroline, from Muirhouse in Edinburgh, uses cash as she finds it easier to budget.

“It’s much easier to control your spending when it’s physically in your hand. If you are low-income and you just want to pop into the shop for a pint of milk, a lot of places want you to have cash,” she said.

But she finds that access to cash is becoming increasingly difficult.

Sometimes she doesn’t have the energy or the will to get on a bus just to go and get her own cash to do something like topping up her electricity meter or buying groceries.

Caroline is one of a growing number of people affected by financial exclusion – a situation where people do not have access to mainstream services such as bank accounts, affordable credit, insurance and savings.

It can affect anyone – but those living in poverty are particularly vulnerable.

Those with poor health and disabilities or caring responsibilities can be disproportionately affected by financial exclusion.

Caroline told BBC Scotland News: “I have become very dependent upon delivery services but they charge you as well.

“It’s not just a delivery charge – there is also a service charge. It just racks up and you end up with something that would cost you £5 in the shop, costing you £10 by the time you put all the charges on it.

“It just makes everything more expensive and everything more difficult.”

Caroline’s local shop in Muirhouse, Costless Express, is run by Urfan Hussain and his family.

They have owned the business for 30 years but rising costs are getting more difficult to manage. They often have to pass extra expenses on to the customer.

“Every month we pay about £700 on average for the card transactions. So that’s basically £700 out of your profits whereas cash, when people used to use cash every day it was great.

“Now we’re about 70% card and about 30% cash. So it’s a huge chunk for family businesses to pay, a lot of customers don’t realise.”

Urfan runs a post office within the shop, where customers can withdraw cash at no extra cost.

“We always say to them come and use a post office because it’s free of charge. Because it’s a local community we try to help as much as we can. We know that people struggle.”

But if the post office is closed, Caroline faces cash machine charges.

‘Poverty premium’

Financial Inclusion for Scotland (FIFS) is a group of policymakers and professionals from the private, charity and not-for-profit sectors trying to tackle financial exclusion.

FIFS wants everyone to have fair access to services like cash and local bank branches regardless of their background.

It is calling on the Scottish government to prioritise the allocation of “dormant assets” towards solving financial exclusion in Scotland.

That means directing money from abandoned accounts that banking customers no longer use towards a more inclusive banking industry.

This money is already used to fund youth projects and it is hoped it could help eliminate extra banking costs for low-income households.

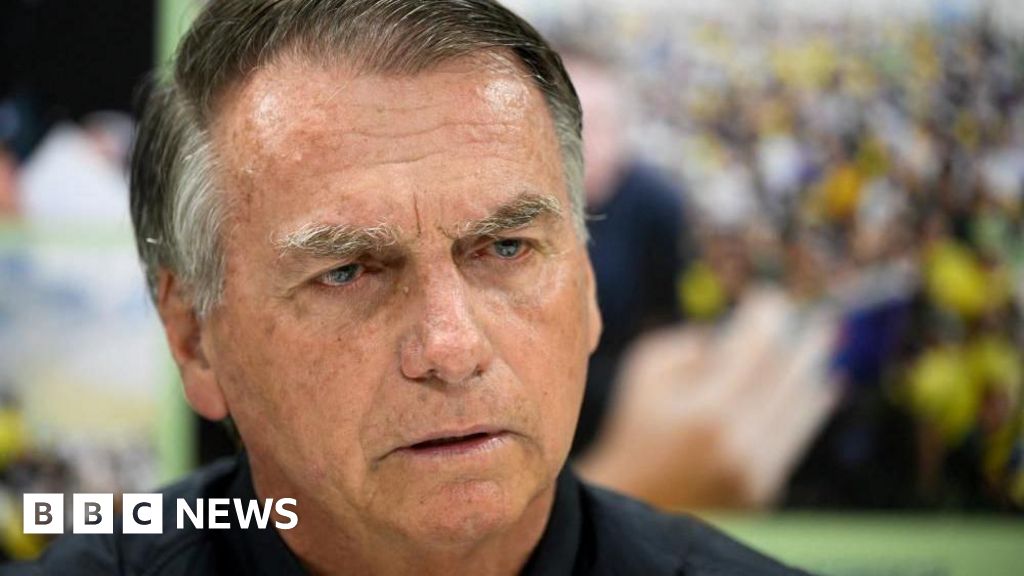

Steven Pearson, the chair of FIFS, told BBC Scotland News: “We have a big problem with poverty in this country – over one million Scots are thought to be living in poverty.

“One of the really hard things about people with less income is that they pay more for things, that’s called the poverty premium.

“It’s just not fair. Can you imagine if the government passed a law that said poor people must pay more for services? There would be outrage. “

In the FIFS’s first financial inclusion strategy, it calls for the establishment of a £20m fund to increase community lenders and expand the availability of affordable credit.

Mr Pearson wants support from mainstream banks for people who are on the fringes of banking – people who don’t yet have a full bank account, or have got a basic account, but might be struggling with managing their overdraft.

“The charges can be very extensive so I think the banks need to take a long hard look at how they could give more support to people in that part of society,” he said.

The Dormant Assets Scheme could potentially release a further £880m for good causes.

A Scottish government spokesperson said: “Following review and consultation by the UK government, the Dormant Assets Act 2022 will enable the scheme to be expanded to include not just bank and building society accounts but also dormant assets across the insurance, pensions, investment, wealth management and securities sectors.

“While it is expected this will lead to an increase in the funding Scotland receives from the scheme, the extent and timing of this are still unknown.”