Cost of living correspondent

Getty Images

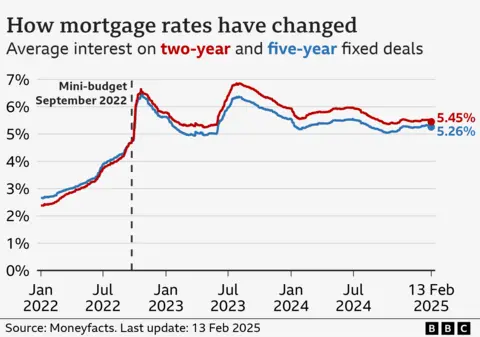

Getty ImagesTwo major lenders launched mortgage deals on Thursday with interest rates of less than 4%, as competition picks up in the sector.

The prospect of further cuts in the base rate by the Bank of England has given mortgage providers confidence to reduce their own rates.

But the attention-grabbing sub-4% deals by Santander and Barclays will not be available to all borrowers, particularly first-time buyers, and may come with a hefty fee.

The return of such deals might prompt other lenders to follow suit after a period of tepid competition.

Mortgage deals with interest rates below 4% have not been seen since November.

Across the whole market the average rate on a two-year fixed deal is 5.48%. The typical rate on five-year deals is 5.29%, according to latest figures from Moneyfacts.

“Borrowers have been crying out for better mortgage rates and we are starting to see them,” said Aaron Strutt, of broker Trinity Financial.

“If your mortgage is coming up for renewal soon and you have already selected a new deal, it is a good time to review it and potentially swap to a better rate.”

Time to decide

Some tracker and variable rate mortgages move fairly closely in line with the Bank’s base rate, which was cut to 4.5% a week ago. However, more than eight in 10 mortgage customers have fixed-rate deals.

The interest rate on this kind of mortgage does not change until the deal expires, usually after two or five years, and a new one is chosen to replace it.

About 800,000 fixed-rate mortgages, currently with an interest rate of 3% or below, are expected to expire every year, on average, until the end of 2027.

That means a higher monthly bill for many homeowners on their next renewal, but there are signs that the rate they could pay is on its way down.

Bank of England governor Andrew Bailey said the interest-rate setting committee expected to be able to cut rates further “but we will have to judge meeting by meeting, how far and how fast”.

This will affect savers who are seeing lower returns, but could bring better news for borrowers. The Bank’s next rates decision is on 20 March.

The markets and lenders are expecting more base rate cuts this year, seen through so-called swap rates. So, rates for new fixed mortgage deals are predicted to fall – especially as mortgage providers tend to move as a pack.

“It was only a matter of time for lenders to bring back sub-4% mortgages,” said Rachel Springall, from financial information service Moneyfacts.

“This is a positive injection to the mortgage market and when a big lender makes such a move, it can prompt its peers to follow suit with cuts of their own.

“The millions of mortgage borrowers looking to refinance this year need some good news.”

Read the small print

Eligible borrowers for the sub-4% rates will need a 40% deposit, which will shut off these deals to many borrowers, especially some first-time buyers.

They may also have a relatively large fee, so borrowers will need to check whether the overall value works for them.

More demand for homes from buyers could be generated if mortgage rates fall for a prolonged period.

In its latest survey, the Royal Institution of Chartered Surveyors (RICS) said that housing market activity was expected to pick up over the coming months following a flat start to the year.

Separate figures show landlords have been feeling the pressure from relatively high mortgage rates.

Repossessions of properties from landlords in England and Wales hit another record high last year, according to the Ministry of Justice.

Both repossession claims – the start of the process – and actual repossessions rose in the final quarter of the year, with cases concentrated in London.

That, in turn, could create problems for availability for tenants if these homes are lost to the rental sector.

Ways to make your mortgage more affordable

- Make overpayments. If you still have some time on a low fixed-rate deal, you might be able to pay more now to save later.

- Move to an interest-only mortgage. It can keep your monthly payments affordable although you won’t be paying off the debt accrued when purchasing your house.

- Extend the life of your mortgage. The typical mortgage term is 25 years, but 30 and even 40-year terms are now available.