First-time buyers are borrowing through mortgages that last an average of 31 years as the affordability of homes remains a stretch.

A decade ago, the average mortgage term for those buying a first home was 28 years, according to figures from banking trade body UK Finance.

Higher mortgage rates have pushed people to borrow for longer to keep their monthly repayments as low as possible.

Despite mortgage rates having fallen recently, these terms are showing no sign of dropping again.

Lenders tend to allow mortgage terms up to a maximum of 40 years.

These have been popular among first-time buyers, many of whom are in their 30s, who are stretching their finances to allow them to buy a property.

It meant the average term for a mortgage lengthened in 2022-23, and has not really dropped since.

While many young homeowners are choosing these long mortgage terms to make repayments more manageable, they may opt for shorter terms in the future if their salaries improve or they move house.

A longer term means the monthly repayments are lower, but the loan overall would be more expensive because interest is paid for longer.

UK Finance said the amount they initially spent on mortgage payments relative to their income was still high.

“Even as interest rates have come down, this measure of affordability has not eased significantly, with rising house prices largely offsetting any lowering of payments through falling rates,” its review of household finances said.

First-time buyers were among a host of people who rushed to complete property purchases before a change in stamp duty on 1 April.

Temporary changes to thresholds, made in 2022, reverted back in April. It means buyers of properties in England and Northern Ireland now pay stamp duty on homes bought for more than £125,000. First-time buyers pay on homes bought for more than £300,000.

The UK Finance data shows that property completion numbers were much higher in the first three months of the year compared with the same period a year earlier.

This peaked in March, immediately before the deadline, when first-time buyer completions were 113% higher than the same month a year earlier. Existing homeowner completions soared by 140% over the same period.

However, data shows there has been, and will be, a significant drop-off after the deadline.

Mortgage approvals for house purchases, which is an indicator of future borrowing, decreased for the fourth consecutive month in April, according to the latest figures from the Bank of England.

That reflects some of the affordability challenges faced by new buyers.

However, various commentators have suggested there is still some momentum in the UK housing market, mainly due to low levels of unemployment.

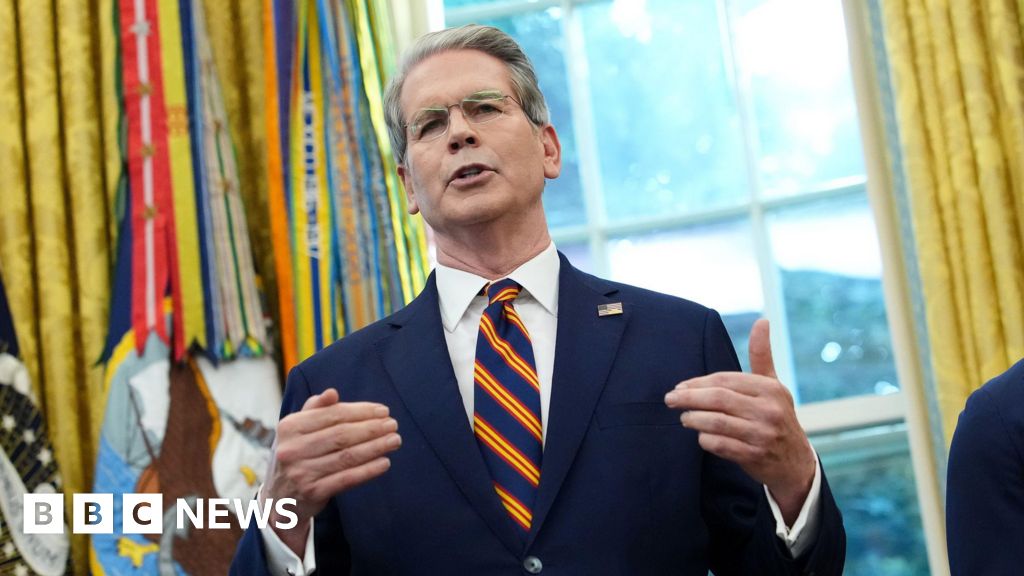

“Despite wider economic uncertainties in the global economy, underlying conditions for potential home buyers in the UK remain supportive,” said Robert Gardner, chief economist at Nationwide.

The building society said house prices rose by 0.5% in May, following a slight drop in April. It said property values were up by 3.5% over the last year, meaning the average home cost £273,427.