Gemma DillonWest Yorkshire political reporter, in Westminster

Plenty of people have questions for the Chancellor after this year’s Budget, but very few will ever get to put them directly to Rachel Reeves.

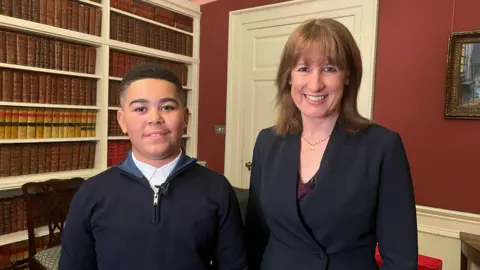

Theo, an 11-year-old from Doncaster, was given the chance to do just that.

He has been campaigning for more financial education in England’s schools and received an invitation to Downing Street after the Chancellor heard about him on the BBC’s Politics North show.

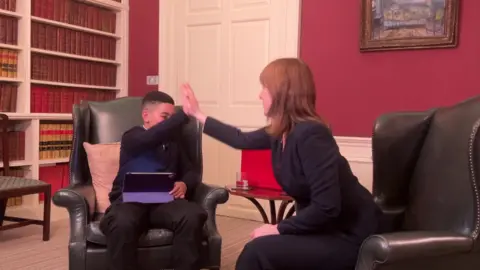

The BBC was invited along to capture the pair’s conversation about how the next generation should learn to manage money.

Getting to know each other

Theo: We have a family evening once a week. Do you have a family evening too?

Chancellor: Yes. Do you have brothers and sisters Theo?

Theo: I’ve got three. My older brother is 12, my sister is eight and my youngest brother is four.

Chancellor: I’ve got two children who are 12 and 10.

The meal that I really enjoy is Sunday lunch because I’ve got most of my weekend work done and my favourite food is roast dinner.

So this Sunday, we had roast beef and Yorkshire pudding. So that is my favourite thing with my family, to be able to do that.

Down to business

Theo: It’s great that the government have passed financial education to be put on the curriculum. How will this be implemented?

Chancellor: So you are at secondary school, aren’t you? But you started saving when you were at primary school. Is that right?

Theo: Yeah, I was eight years old.

Chancellor: That’s amazing. How come you decided to do that?

Theo: My mum and dad didn’t really know how to save so I wanted to help them. And I want to be able to save up to buy a house and get a car.

Chancellor: And do you work hard at school? What’s your favourite subject?

Theo: It’s maths. And I work really hard at school.

Chancellor: Good answer Theo. Everyone’s favourite subject should be maths. I don’t know why it isn’t. That was my favourite subject at school. So you’re saving money – do you save it in a bank or a building society?

Theo: I save it in a savings account.

Chancellor: And do you put money in at birthdays and Christmas? Bits of pocket money? Things like that?

Theo: Yes…pocket money.

Chancellor: That’s really good. So instead of going out and spending your pocket money – which is what most kids do (probably what my kids do) – you save your money because you are thinking of your future.

So what we’re doing as a government is making sure even at primary school people are taught a bit more about budgeting and about money.

I know you learn about different coins and notes and adding up money if you’re in a shop. But things about budgeting like you’re talking about – this is how much a car would cost, this is how much a deposit on a flat or a house would cost, this is how much I should save up.

Things about interest as well. So if you put money in a savings account, probably every month and every year that money will grow a little bit. So if you have £100 in savings and the interest rate was 2%, at the end of the year you would have £102 – or if interest rate was 3%, you’d have £103.

And that means every year you’re not just saving the money, but that money is growing as well. So by the time you are 18 or 21, you’ll have more money than the amount you originally put in. Does that sound good?

Theo: Yes.

BBC/Gemma Dillon

BBC/Gemma DillonTheo: I have to teach my parents about the importance of savings. What kind of things do you do to teach your kids?

Chancellor: So we’ve set up online bank accounts for my children. We pay their pocket money into there and my older daughter has a card that she can use to buy things.

But they both have a login and can see what money they’ve got when their pocket money goes in.

Now my daughter, she likes spending her money. My son he doesn’t really touch his money, but like you thinks it is important people put something aside.

When I first started saving, it was all paper-based and you had this little book you had to take in to the building society if you wanted to pay money in or take it out.

I remember when I got a Saturday job when I was 14 or 15 I was then able to put some money from my Saturday job into my bank account. And maybe you might get a paper round or clean people’s cars and money you get from that. Sure you can spend a bit of it, but also put some money aside so you can get that car or a deposit on a house one day.

And finally…

Theo: I hear you have quite a few advisors when doing the Budget. Fancy taking another one?

Chancellor: [Laughs] I think you’d be brilliant Theo.

Theo: Don’t worry, I’m not too expensive.

- The full interview will be on Politics North on BBC1 on Sunday 14 December at 10am and on iPlayer afterwards.