By Kevin Peachey, Cost of living correspondent

Getty Images

Getty ImagesCompetition between mortgage lenders has intensified ahead of a key decision on interest rates by the Bank of England.

A host of lenders have made reductions to the cost of new fixed-rate mortgages in recent days.

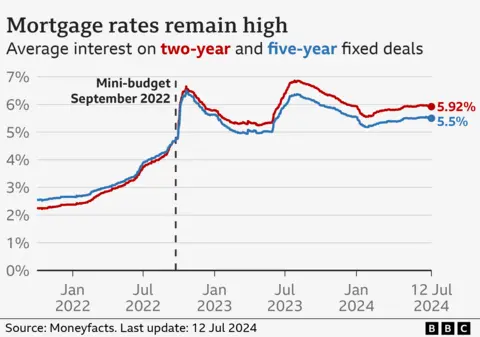

Brokers expect further cuts to come, but mortgage rates remain much higher than homeowners became accustomed to for a decade.

Lenders’ funding costs have hinted at falling with the Bank forecast to cut benchmark interest rates for the first time in four years.

Analysts believe that move, from the current 16-year high of 5.25%, could come on 1 August, although this remains far from certain.

Costly loans

The interest rate on a fixed mortgage does not change until the deal expires, usually after two or five years, and a new one is chosen to replace it. Doing nothing would leave people on a variable rate, which can be very expensive.

About 1.6 million existing borrowers have relatively cheap fixed-rate deals expiring this year.

They may be moving off a rate of less than 2%, so face significantly higher repayments on their next home loan.

The average rate on a two-year fixed deal is 5.92%, according to the financial information service Moneyfacts. The average five-year fixed rate is 5.5%.

The prospect of a lower Bank of England rate has offered better signals for lenders’ funding costs, leading many to lower the rates they charge customers.

They will also study the moves of their rivals, and their own levels of custom, to judge where they set the costs.

Many major banks have cut rates in the last two weeks, including Barclays which has done so three times, as well as Nationwide, Virgin, Coventry and Skipton, among others.

Aaron Strutt from mortgage broker Trinity Financial said there was “more positive news” coming from lenders. He suggested anyone who had recently agreed a new deal might still have time to renegotiate something better.

While the moves have led some to suggest sub-4% deals could return to the market soon, others are more cautious.

Kylie-Ann Gatecliffe, from KAG Financial, said many predictions of falling rates had proved to be wrong.

However, she said clients were telling her they had chosen to move now, having delayed during the upheaval of the last couple of years.

She said people were looking in more detail at their options, such as whether to borrow more to move home, or instead to fund home improvements.

‘Knife-edge’ decision

A recent report by the Bank of England said that about three million households were set to see their mortgage payments rise in the next two years, including 400,000 mortgage holders who were facing some “very large” payment increases.

Renters also remained under pressure from the cost of living and higher interest rates, it said.

Leading lenders have also said that housing affordability is stretched owing to high mortgage rates.

The UK economy grew faster than expected in May, leading some analysts to comment that a cut in interest rates by the Bank was more likely in August, while admitting the decision was still on a knife-edge.

Ways to make your mortgage more affordable

- Make overpayments. If you still have some time on a low fixed-rate deal, you might be able to pay more now to save later.

- Move to an interest-only mortgage. It can keep your monthly payments affordable although you won’t be paying off the debt accrued when purchasing your house.

- Extend the life of your mortgage. The typical mortgage term is 25 years, but 30 and even 40-year terms are now available.