Kevin PeacheyCost of living correspondent and

Tommy LumbyBusiness data journalist

Getty Images

Getty ImagesSpontaneous spending is likely to rise if the limit on contactless cards is increased or scrapped entirely, academics say.

At present, the need to press a four-digit PIN for purchases over £100 gives people a timely prompt about how much they are paying, lowering the risk of debt-fuelled purchases.

Earlier this week, the UK’s financial regulator proposed that banks and card providers set their own limits, or are allowed to remove them entirely. That would make entering a PIN even more of a rarity.

Banks, and some BBC readers, say consumers should be able to set their own contactless limits, as debate on the issue picks up ahead of a final decision later in the year.

Reckless or over-regulated?

Contactless payments have become part of everyday life for millions of people across the world.

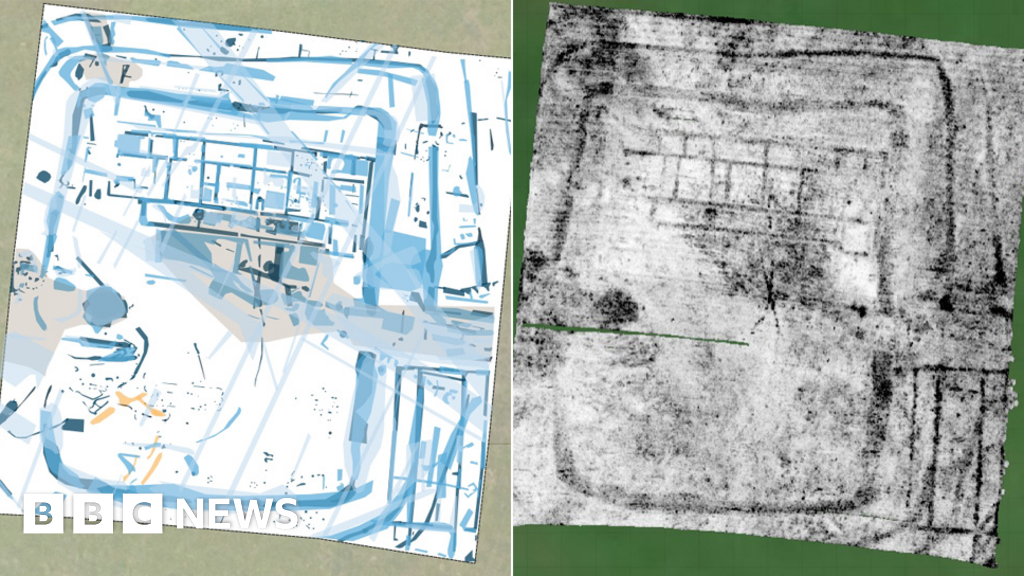

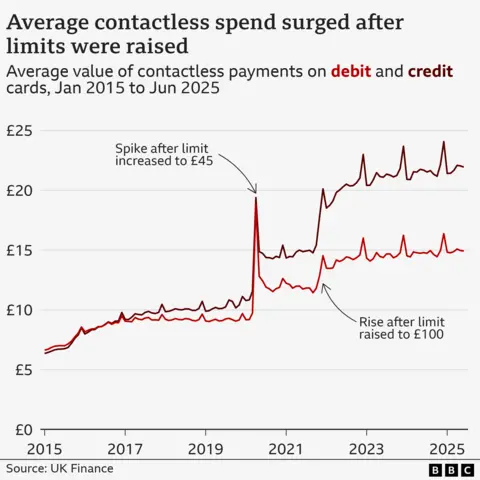

When they were introduced in the UK in 2007, the transaction limit was set at £10. Increases in the threshold since then included relatively big jumps around the time of the pandemic, to £45 in 2020, then to £100 in October 2021.

They prompted surges in the average contactless spend.

Clearly, the average would rise because more, higher value, purchases could be made via contactless, without a PIN.

But what is much harder to quantify is whether people were spending more frequently, and larger amounts, than would have been the case if they had needed to enter a PIN.

Richard Whittle, an economist at Salford Business School, says the extra convenience for consumers can come at a cost.

“If this ease of payment leads to consumers spending without thinking, they may be more likely to buy what they don’t really want or need,” he says.

He says this could be a particular issue with credit cards, when people are spending borrowed money and accumulating debt. He believes regulators should consider whether to have different rules for contactless credit cards than for contactless debit cards.

Stuart Mills, a lecturer in economics at the University of Leeds, says cash gives “visible and immediate feedback” on how much money you have, while a PIN is an “important friction point” for controlling spending.

“Removing such frictions, while offering some convenience benefits, is also likely to see many more people realising they’ve spent an awful lot more than they ever planned to,” he says.

Both these academics have raised this concern before, but this is not solely a theoretical argument.

In the Kent market town of Sevenoaks, shopper Robert Ryan told the BBC that entering a PIN “does give me a bit of a prompt to make sure I’m not overspending on my tap-and-go”.

However, the reality for many people is that, under pressure from the cost of living, they are rarely spending more than £100 in one go anyway, so contactless has become the norm.

Research by Barclays suggests nearly 95% of all eligible in-store card transactions were contactless in 2024.

Terezai Takacs, who works in a florists in Sevenoaks, says that over the last couple of years people were cutting back on spending, such as asking for smaller bouquets.

Technology takeover

Ms Takacs also points out that the majority of customers now pay via the digital wallet on their smartphone.

Paying this way already has an unlimited payment limit, owing to the in-built extra security features such as thumbprints or face ID.

Dr Whittle says that is likely to dilute the impact of raising the contactless card limit on spontaneous, or reckless, spending – because young people, in particular, are paying by phone.

Some say scrapping the contactless card limit is overdue, because it is far less relevant when people are accustomed to PIN-free spending on a phone.

“Regulators are finally catching up with how people actually pay,” says Hannah Fitzsimons, chief executive at fintech company Cashflow.

“Digital wallets on smartphones face no limits, so why should cards be stuck in the past?”

If the contactless card limit were to increase or be scrapped, then it would push the UK further on than much of Europe, and more in line with rules in other advanced economies.

In Canada, the industry sets the level rather than regulators, and it is set by providers in the US and Singapore – a model which the Financial Conduct Authority (FCA) wants to replicate in the UK.

Banks agree with the regulator, although UK Finance – the industry trade body – says “any changes will be made thoughtfully with security at the core”.

Personal choice

Banks and card providers that do change limits will be encouraged to allow customers to set their own thresholds, or turn off contactless entirely on their cards.

Gabby Collins, payments director at Lloyds Banking Group – the UK’s biggest bank, says: “Lloyds, Halifax and Bank of Scotland customers can already set their own contactless payment limits in our apps – in £5 steps, up to £100 – and we’re absolutely committed to keeping that flexibility.”

That option has support among some BBC readers, viewers and listeners who contacted us on this topic through Your Voice, Your BBC News.

Ben, aged 36, from London, told us: “The most important principle here is personal choice. I would like to set my own personal limit.

“It is my card and my choice based on convenience and risk tolerance. Some banks do not allow for this. This option has to be provided to everyone.”

Others have concerns over security, saying that unlimited contactless cards would become more of a temptation to thieves and fraudsters.

‘Limitless abuse’

Charities warn that not everyone has the digital skills to set their own limits. In other circumstances, it can have an extremely serious impact on people’s lives.

Sam Smethers, chief executive of Surviving Economic Abuse, says unlimited contactless cards give controlling partners the opportunity for limitless economic abuse.

“Unlimited contactless spending could give abusers free access to drain a survivor’s bank account with no checks or alerts,” she says.

“This could leave a survivor without the money they need to flee and reach safety, while pushing them even further into debt.”

She warns that it could also hasten the shift towards a cashless society.

Cash is a lifeline to many survivors because it was the only way to escape abusers who can monitor online transactions, withhold bank cards and close down bank accounts, she says.

Additional reporting by Andree Massiah