Business reporter

Political reporter

House of Commons

House of CommonsTaxes may have to rise in the autumn, economists have warned, despite big welfare cuts and spending reductions in Wednesday’s Spring Statement.

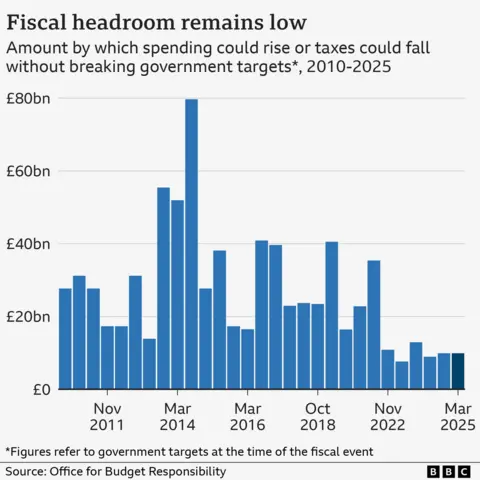

Chancellor Rachel Reeves has only a small margin of headroom to deal with unexpected developments.

The independent watchdog, the Office for Budget Responsibility (OBR), has warned global uncertainty due to the impact of US President Donald Trump’s tariffs could hit the UK economy and derail Reeves’s plans.

Reeves has not ruled out further tax rises but told the BBC there were “opportunities” as well as “risks” for the UK economy.

Paul Johnson, director of the Institute for Fiscal Studies think tank, said Trump’s announcement overnight demonstrated “we live in a risky and changing world”, adding that the chancellor’s headroom “remains very small”.

“There is a good chance that economic and fiscal forecasts will deteriorate significantly between now and an autumn Budget,” he said.

“If so, she will need to come back for more; which will likely mean raising taxes even further.”

He added that “months of speculation” over which taxes might rise could have “damaging” political and economic consequences.

In its election manifesto Labour promised not to increase taxes on “working people”, covering National Insurance, Income Tax and VAT.

However, in last autumn’s Budget the government increased National Insurance contributions for employers, saying the hike was needed to plug a “black hole” in the nations finances and invest in the NHS and other public services.

Asked on Wednesday if there could be more tax rises in October, Reeves said: “We’ll never have to do a Budget like that again.”

Pressed on BBC Radio 4’s Today programme over whether if things went wrong there may need to be more tax rises or spending cuts, the chancellor acknowledged “there’s always risks” but said there were also “opportunities” for economic growth from housebuilding and reforms to the planning system.

The OBR halved its growth forecast for the UK this year to 1%, down from its October prediction of 2%.

But in subsequent years the watchdog predicted growth would be higher than expected thanks, in part, to more housebuilding.

The chancellor has insisted she will stick to her self-imposed “fiscal rules” – designed to reassure financial markets.

The two key ones are not to borrow to fund day-to-day public spending and to get government debt falling as a share of national income by the end of this parliament.

The chancellor said changes in the global economy meant she would have missed her rule on spending by £4.1bn due to an increase in government borrowing costs.

She said measures announced on Wednesday “restored in full our headroom” to £9.9bn.

But OBR chairman Richard Hughes warned that if the US levied tariffs of 20% on imports, and the UK and the rest of the world retaliated with the same, this could “wipe out” the chancellor’s headroom.