Thames Water has won a crucial High Court battle to secure a £3bn rescue loan, staving off the prospect of the debt-laden company coming under government control.

The UK’s largest water and waste company was set to run out of cash by the end of March and would have likely been placed into temporary nationalisation to keep services running.

The court decision on Tuesday has given the supplier a financial lifeline to undergo a major restructure, but the future of the company remains uncertain as it struggles with around £17bn worth of debt.

Thames has also faced heavy criticism over its performance in recent years following a series of sewage discharges and leaks.

The government has been on standby to put Thames Water – which serves about a quarter of the UK’s population and employs 8,000 people – into special administration since the dire state of the company’s finances emerged about 18 months ago.

Regardless of what happens to the company in the future, water supplies and waste services to households will continue as normal.

In its latest bid to survive, lenders offered Thames a further loan of up to £3bn in two instalments as it attempts to restructure the business.

However, it ended up in the High Court after a group of creditors opposed the plan and argued the 9.75% interest rate on the loan was too costly.

A High Court judge approved the restructure plan on Tuesday.

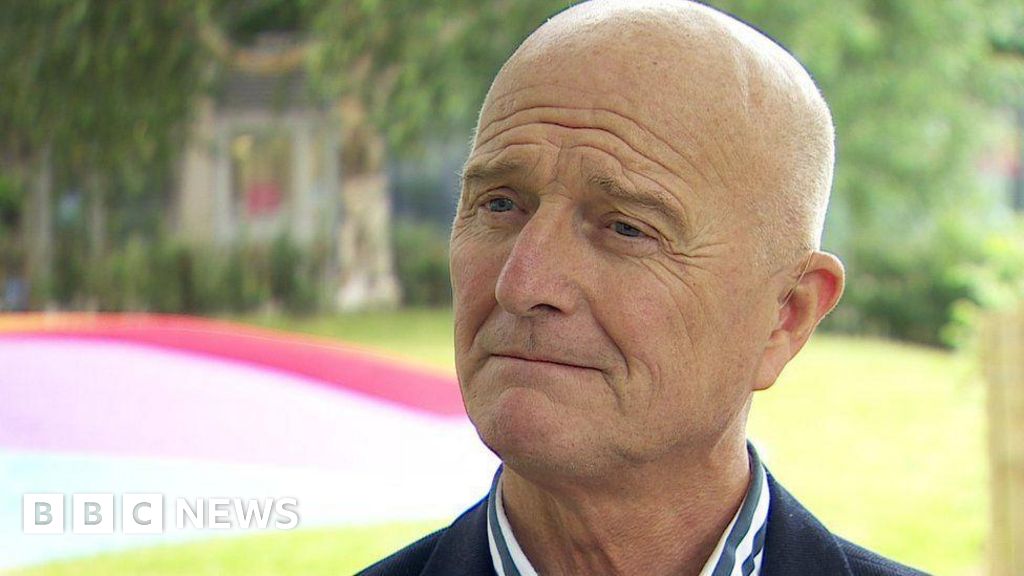

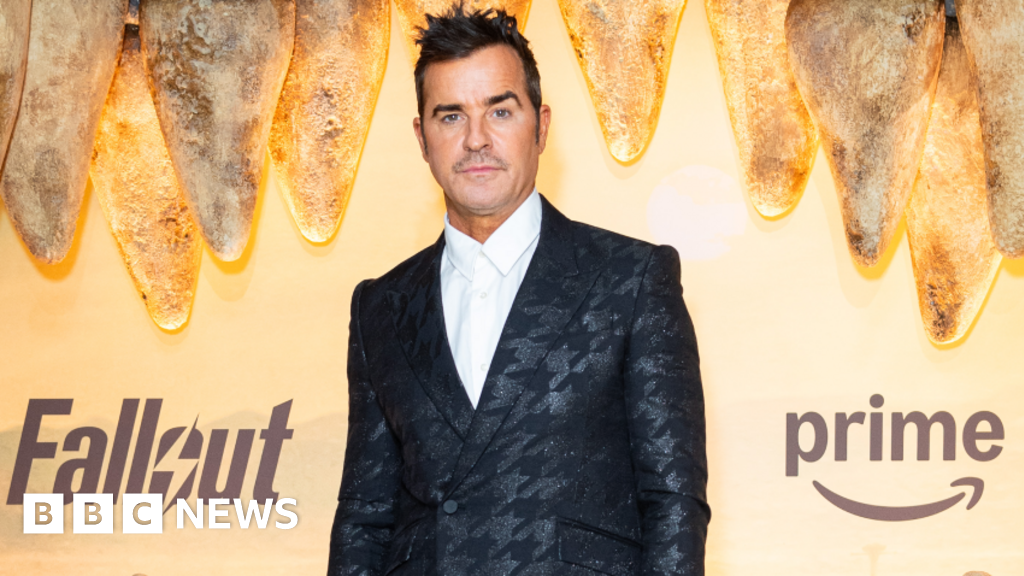

Following the victory, Sir Adrian Montague, chairman of Thames Water, said it marked a “significant milestone” for the company while chief executive Chris Weston said it “puts our business on a firmer financial footing”.

Thames has insisted its emergency funding will provide it the breathing space to complete a major restructuring of its debts and attract a cash injection from prospective new investors.

A first payment of £1.5n will see the company through to the autumn.

A second instalment will be used to fund the company as it appeals a decision by Ofwat, the industry regulator, over how much Thames can raise household bills by – a process which could take up to a year.

On Friday, Thames launched an appeal to allow it to increase bills by more than the regulator had granted.

Ofwat has capped bill rises at 35% over the next five years, but Thames has argued bills need to increase by 53%.