Business reporter, BBC News

Getty Images

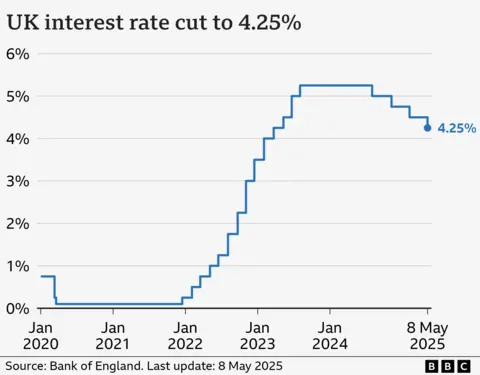

Getty ImagesInterest rates have been cut to the lowest level in about two years after the Bank of England reduced them to 4.25% from 4.5%.

Bank governor Andrew Bailey said the slowdown in inflation was behind the decision to cut, but warned recent weeks had shown “how unpredictable the global economy can be” following the introduction of wide-ranging US tariffs.

The Bank’s rate-setting committee was divided – five members voted to cut rates to 4.25%, two voted in favour of a larger reduction to 4% and two voted for no change.

The decision comes as the details are set to be announced over a tariff deal between the UK and US later on Thursday.

Currently, most goods imported from the UK to the US face a blanket 10% tariff, with higher import taxes on steel and cars.

The Bank said uncertainty surrounding the future of global trade had “intensified” as a result of tariffs, but added that regardless of whether or not a pact was struck with the US to avoid them, “the negative impacts on UK growth and inflation are likely to be smaller”.

It said that the impact of tariffs on the UK was likely to be a slowdown in price rises rather than an increase, as countries hit hard by US import taxes, such as China, look to establish new trade routes.

The latest UK inflation figures shows prices rose 2.6% in the year to March, although a series of household bill increases at the start of April – including energy and water prices – mean the rate is expected to climb higher.

The Bank said it expected inflation to rise “temporarily” to 3.5% this year due to the bill increases before falling back, with lower oil and gas prices set to feed through in the coming months.

Employers were also hit with a rise in National Insurance last month, but the Bank said the effect of the tax increase “appears to have been fairly small to date”, though it added business confidence had taken a hit in recent months.

Mr Bailey said “ensuring low and stable inflation” was the Bank’s top priority, adding it needed to “stick to a gradual and careful approach to further rate cuts”.

The cut in rates to 4.25% marks the fourth reduction from last year’s peak of 5.25%, and the second so far this year.

Interest rates are the Bank’s main tool in try to maintain the annual rate of inflation at, or close to, its target of 2%.

The influential International Monetary Fund has predicted that the Bank could cut rates two more times this year,

The Bank’s base interest rate dictates the rates set by High Street banks and lenders. The higher level in recent years has meant people are paying more to borrow money for things like mortgages and credit cards, but savers have also received better returns.

About 600,000 homeowners have a mortgage that tracks the Bank’s rate, so rates being cut will have an impact on monthly repayments.

More than eight in 10 customers have fixed-rate deals, but could continue to face higher repayment costs when renewing.

Mortgage rates have been edging down recently, primarily because the markets and lenders expect further rate cuts this year.

The theory behind increasing interest rates to tackle inflation is that by making borrowing more expensive, more people will cut back on spending and that leads to demand for goods falling and price rises easing. But it is a balancing act as high interest rates can harm the economy as businesses hold off on investing in production and jobs.

However, the Bank has forecast UK growth for the first three months of this year to be stronger than expected at 0.6%. The official figures are set to be released next week.

A boost in growth would be welcome news to the government, which has made growing the economy its main priority in order to boost living standards.

Earlier this year the Bank halved its growth forecast for the UK to 0.75%, down from its previous estimate of 1.5%.

The theory behind increasing interest rates to tackle inflation is that by making borrowing more expensive, more people will cut back on spending and that leads to demand for goods falling and price rises easing. But it is a balancing act as high interest rates can harm the economy as businesses hold off on investing in production and jobs.

However, the Bank has forecast UK growth for the first three months of this year to be stronger than expected at 0.6%. The official figures are set to be released next week.

A boost in growth would be welcome news to the government, which has made growing the economy its main priority in order to boost living standards.

Earlier this year, the Bank halved its growth forecast for the UK for this year to 0.75%, down from its previous estimate of 1.5%.