Business reporter, BBC News

Getty Images

Getty ImagesThe Bank of England has cut UK interest rates from 4.25% to 4%, the lowest level since March 2023.

The Bank of England interest rate can affect mortgage rates and interest rates on savings, as well as the speed at which prices change and how the jobs market performs.

Here’s what that all means for you.

What the rate cut means if you have a mortgage

The Bank of England’s interest rate is what the central bank charges other banks that want to borrow money.

That then influences what interest rates those banks charge their customers for loans such as mortgages.

How the rate cut will affect mortgage repayments depends on the type of mortgage households have, and some could feel the difference quite quickly.

For those with a standard variable rate mortgage of £250,000 over 25 years, repayments will fall by £40 a month, according to financial information company Moneyfacts.

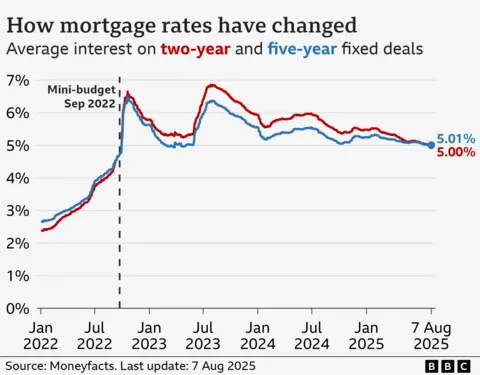

But most people with home loans have either a five-year or two-year fixed term mortgage. According to Moneyfacts, those interest rates have continued to fall, reaching 5.01% for five-year loans and 5% for two-year loans this month.

That will be little comfort to people coming off low five-year rates of below 3% soon, but welcome news for those re-fixing two-year rates which had been above 6% in August 2023.

What the rate cut means for your savings

While lower interest rates are good news for households with home loans, it is a different story for those with savings.

Rachel Springall, a finance expert at Moneyfacts, said the average savings rate is currently 3.5%, which is 0.42% lower than this time last year and is expected to keep falling. She said the average easy access ISA rate had also fallen by 0.46% over the year.

“Savings rates are getting worse and any base rate reductions will spell further misery for savers,” Ms Springall said.

According to Samuel Fuller, director of Financial Markets Online, the announcements on Thursday had “done two things for savers – neither of them good.”

While the cut in rates drives down the interest paid on savings accounts, the new forecast that inflation – the increase in the price of something over time – will rise to 4% in September also has an effect.

“The combination of rising inflation and falling interest rates will slash the value of people’s savings in real terms,” he said.

How does it affect prices?

The Bank of England’s main job is to ensure the UK has a stable financial system, by ensuring that the prices of goods and services used by households and businesses do not rise too quickly.

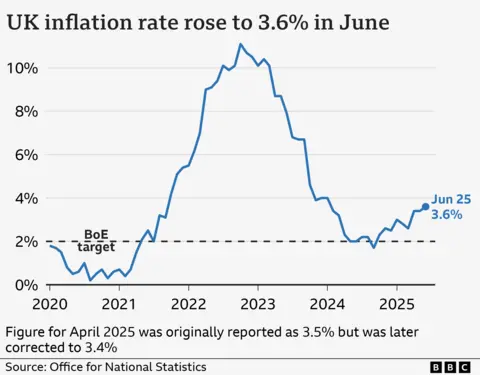

The Bank has a target to keep that increase in prices – known as inflation – at 2%.

Inflation is currently 3.6%, and the Bank expects it to reach 4% by September.

Within that, rising food prices are a particular concern – and maintaining rates at their previous level of 4.25% could have helped to to keep a lid on that.

Cutting the interest rate makes it cheaper to borrow money which people can then spend on goods and services, potentially stoking inflation. Increasing interest rates makes saving money more attractive, reducing spending in the economy and bearing down on prices.

So why would the Bank go ahead and cut interest rates if inflation is too high?

As the Bank of England pointed out, inflation is not the only problem in the UK economy.

According to its the report it released on Thursday, the economy is struggling to grow, and the jobs market is beginning to weaken. Those are factors that should benefit from lower interest rates.

How does this affect jobs and businesses?

The Bank would have been thinking about the impact on businesses, too.

Higher inflation can increase companies’ operating costs, meaning it can affect business decisions.

For example, if the cost of doing business rises, companies might put off hiring new people, or even cut staff. Recent figures show that the number of job vacancies has fallen, while the jobless rate has increased.

Another thing businesses can do to save money is not raise employee wages, and the Bank expects that wages will grow slowly throughout the rest of the year.

Sluggish wage growth and a tougher jobs market mean households are more likely to spend less, which helps bring inflation down.

Interest rates are a balancing act for the Bank.

The Bank expects inflation to gradually fall, and the the interest rate setters decided – after lengthy discussions – that in this instance lowering the interest rate was the best move.

What could this mean for pensions?

While inflation reaching 4% in the coming weeks will not be welcome news to many households and businesses, one group of people could benefit: pensioners.

Each year, the state pension is increased based on whichever figure is the highest – 2.5%, the average rate of wage growth, or the rate of inflation.

That rate of inflation is taken from the September figure, which is when the Bank of England expects inflation to reach its latest peak.

Helen Morrissey, head of retirement analysis at Hargreaves Lansdown, told the BBC that if inflation hits 4% in September, “then state pensioners on the full new state pension could be in line for around £9.20 extra per week while those on the basic state pension could see it rise by around £7 per week”.