Getty Images

Getty ImagesWhat’s happening in the bond markets?

A bond is a bit like an IOU that can be traded in the financial markets.

Governments generally spend more than they raise in tax so they borrow money to fill the gap, usually by selling bonds to investors.

As well as eventually paying back the value of the bond, governments pay interest at regular intervals so investors receive a stream of future payments.

UK government bonds – known as “gilts” – are normally considered very safe, with little risk the money will not be repaid. They are mainly bought by financial institutions, such as pension funds.

Interest rates – known as the yield – on government bonds have been going up since around August.

The yield on a 10-year bond has surged to its highest level since 2008, while the yield on a 30-year bond is at its highest since 1998, meaning it costs the government more to borrow over the long term.

The pound has also fallen in value against the dollar over the last few days. On Tuesday it was worth $1.25 but is currently trading at $1.23.

Why are bond yields rising?

Yields are rising not just in the UK. Borrowing costs have also been going up in the US, Japan, Germany and France, for instance.

There is a great deal of uncertainty around what will happen when President-elect Donald Trump returns to the White House later this month. He has pledged to bring in tariffs on goods entering the US and to cut taxes.

Investors worry that this will lead to inflation being more persistent than previously thought and therefore interest rates will not come down as quickly as they had expected.

But in the UK there are also concerns about the economy underperforming.

Inflation is at its highest for eight months – hitting 2.6% in November – above the Bank of England’s 2% target – while the economy has shrunk for two months in a row.

Analysts say it is these wider concerns about the strength of the economy that is driving down the pound, which typically rises when borrowing costs increase.

How does it affect me?

Chancellor Rachel Reeves has pledged that all day-to-day spending should be funded from taxes, not from borrowing.

But if she needs more money to pay back higher borrowing costs, that uses up more tax revenue, leaving less money to spend on other things.

Economists have warned that this could mean spending cuts which would affect public services, and tax rises that could hit people’s pay or businesses’ ability to grow and hire more people.

The government has committed to having only one fiscal event a year, where it can raise taxes, and this is not expected until the autumn.

So if higher borrowing costs persist, we may be more likely to see cuts to spending before that or at least lower spending increases than would otherwise happen.

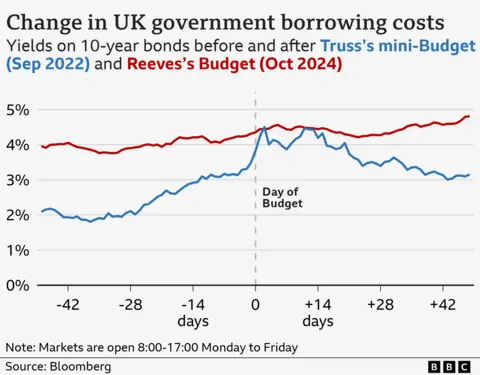

Some people may be wondering about the impact of higher gilt yields on the mortgage market, particularly after what happened after Liz Truss’s mini-Budget in September 2022.

Although yields are higher now than they were then, they have been creeping up slowly over a period of months, whereas in 2022 they shot up over a couple of days.

That speedy rise led to lenders quickly pulling deals while they tried to work out what interest rate to charge.

Analysts and brokers say the current unease in the markets is having some effect on the pricing of mortgages. Many were expecting to see some falls in rates at the start of the year but instead lenders are holding off from cuts to see what happens.

However, the market is favourable to anyone currently buying an annuity – a retirement income for the rest of their life, bought only once.

One annuity expert told the BBC many people would get a better deal now than at any time since 2008.

What happens next?

The Treasury has said there is no need for an emergency intervention in the financial markets.

It has said it will not make any spending or tax announcements ahead of the official borrowing forecast from its independent watchdog, the Office for Budget Responsibility (OBR), due on 26 March.

If the OBR says the chancellor is still on track to meet her self-imposed fiscal rules then that might settle the markets.

However, if the OBR were to say because of slower growth and higher-than-expected interest rates, the chancellor were likely to break her fiscal rules then that would potentially be a problem for Reeves.