BBC News

Getty Images

Getty ImagesLloyds Bank business customers and whistleblowers have accused it of failing small firms as it tried to reduce lending after the financial crash of 2008.

Business owners who borrowed from Lloyds around that time have told the BBC their firms collapsed after the bank introduced them to its Business Support Unit (BSU), intended for clients it considered were struggling.

A whistleblower told Panorama there was a “pattern” of “pigeonholing” small businesses as “distressed” when they were “salvageable”.

Lloyds said it “categorically denied” the allegations and its BSU “supported many thousands of customers”.

During the banking crisis of 2008, the government bailed out banks to save them from collapse, including Lloyds which got £20bn of taxpayers’ cash.

Then Prime Minister Gordon Brown said as a condition of the bailout banks must protect lending to small and medium sized businesses.

But over 15 years, the BBC has heard allegations that Lloyds’ BSU failed small firms.

James Ducker, who sold financial products to businesses for Lloyds in 2009, said “the approach to lending became do not lend. Beyond that, get as much money back that we’ve lent as possible.”

He said customers in the BSU were “easy pickings”.

A whistleblower who worked for a consultancy firm brought in by Lloyds to advise small businesses in the BSU told BBC Panorama that in their experience the companies described by the bank as distressed “probably weren’t distressed, they were salvageable. I believe there was a pattern. There’s no other way to put it.”

Wishing to remain anonymous, the whistleblower accused the bank of “planning the administration of these entities in advance of reports that were produced. The business plan was completely ignored. They weren’t interested in saving the company.”

Lloyds said: “These historic allegations have been thoroughly investigated by the group and found to be unsubstantiated. They are categorically denied.”

‘I’m going to bloody fight and fight’

In 2009, Martin Woolls, a ferry boat captain from Weston-Super-Mare, had a residential mortgage with HSBC and unsecured loans with Lloyds.

He had recently bought a new boat to expand his business, which he’d been running since 1981, and agreed to combine all his lending into a commercial mortgage and overdraft with Lloyds – both secured against his home.

The overdraft was authorised at an initial rate of 2.75%. However, in the wake of the crash, the rates on Martin’s overdraft surged to 16%. They peaked at 26.4% when he exceeded his overdraft limit. Bank of England base rates at the time remained static at 0.5%.

“Who the hell in the world can cope with those interest rates? Nobody. No business anywhere can cope with that. It’s hideous,” he said.

Lloyds said Martin’s rate rises were “in accordance with the terms” of his agreements and it doesn’t accept they “ultimately distressed” his business “or “led to its collapse.”

By 2016, and with base rates still below 1%, Lloyds called in Martin’s debts.

His business went under, and the bank is still seeking repossession of his home, something Martin is fighting in court. He said the impact of securing the borrowing against his home wasn’t properly explained to him.

Lloyds said “repossession is always a last resort” but it is “required in the interests of depositors and shareholders to protect its security when loans are defaulted upon”.

It said numerous inquiries into Martin’s case have found “no evidence of wrongdoing”.

Unwanted sale

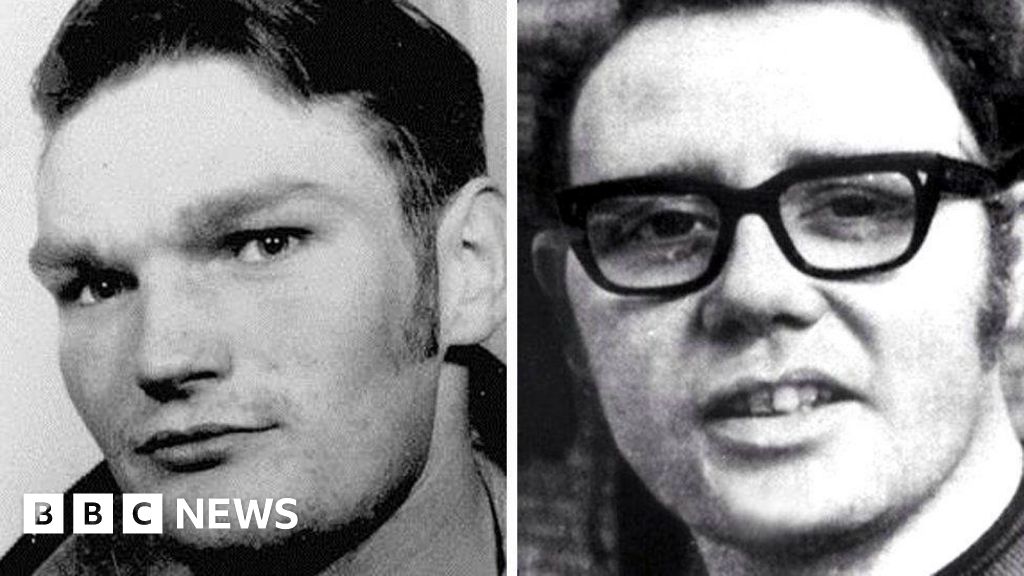

Keith Elliott borrowed £8.6m from Lloyds in 2006 for his Yorkshire-based car auction business.

An internal Lloyds email from July 2008 described Keith’s business as “profitable” but struggling short term with cashflow issues as he redeveloped a new site.

The bank suggested Keith take on a non-executive director from business consultants PwC. Keith agreed but the consultant though not appointed as a non-exec still advised him to re-organise the finances and apply for a further £2m overdraft. And within a week, introduced Keith to the BSU.

However, unbeknown to Keith, PwC was advising Lloyds to sell the business, even though it still belonged to Keith.

In August 2008, a partner at PwC emailed Lloyds saying: “looks like an accelerated sale with a big success fee/warrant for the bank to reflect the equity risk you are taking”.

Keith told the BBC: “The fact of the matter here – was their plan to steal my business behind my back. Yes or no? That’s it. That’s all we need to know.”

Keith didn’t want to sell the business or let Lloyds take a stake, but by December the bank called in its loans and Keith’s business collapsed, with PwC paid to oversee the breakup.

His Leeds business was sold for around £4m, despite being valued at £13m just months earlier, with Lloyds taking a 15% stake.

Lloyds said there was “nothing deceitful or untoward in the introduction” of PwC and that the consultants it worked with had a “proven track record of saving and developing businesses.”

It said the BSU was not “designed to generate profit” and in some circumstances an equity stake may be taken with the agreement of customers “to reflect the level of risk taken”.

It added the insolvency caused it to lose £5.5m and that Keith’s personal spending was draining the company of money.

PwC said: “Mr Elliott’s unsubstantiated allegations have been considered or investigated by multiple authorities, no finding of wrongdoing has been made against PwC or its personnel.”

Keith said Lloyds described his company as “robust” and said it was wrong to blame its failure on his spending.

‘Police backchannel’

Kashif Shabir was a successful property developer who agreed a £3m loan with Lloyds but claims he was pushed by the bank into what he calls a “fire sale” of his assets after the crash.

Kashif suspects the BSU had never really been there to support him, describing it as “an abattoir”.

He turned to Avon and Somerset Police believing he was the victim of a financial crime. Police told him that a review found no evidence of criminality. However, he later discovered that Lloyds had been told he was going to meet with the police and that his case was going to be closed before the meeting had taken place. This was despite police telling him at that meeting that there would be a further review of his case.

The Independent Office for Police Conduct (IOPC) found the police had shared confidential information with Lloyds for “no apparent policing purpose”, but said it found no evidence of corruption.

Avon and Somerset Police denies corruption “in the strongest possible terms”.

Lloyds said it “went to enormous lengths over many years” to try to get the customers in this article “back on track with their repayments, showing considerable forbearance and understanding”.

It added: “Whenever complaints have been made … they have been thoroughly investigated” and “no evidence of any wrongdoing has been found.”

Get our flagship newsletter with all the headlines you need to start the day. Sign up here.